Revisiting 2008 Financial Crisis?

Friday Focus: Highlighting the world, one image at a time.

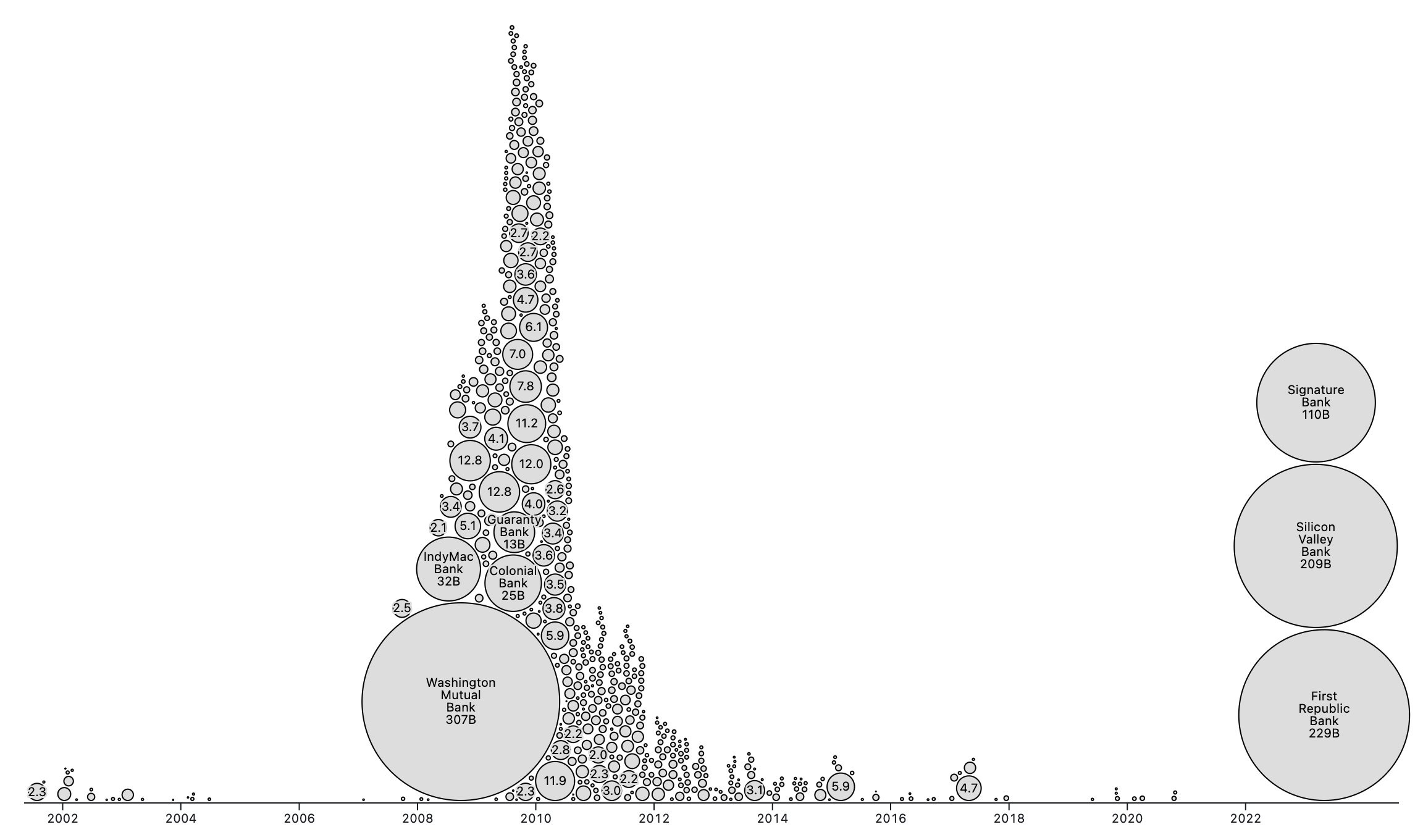

In just two months, we've seen a staggering $500 billion+ in bank failures.

This is a chilling reminder of the 2008 financial crisis. This situation is so alarming that some investors are now more concerned with securing a return of their original investment, rather than seeking a return on their investment.

The Federal Reserve’s rate hikes have triggered a domino effect, leading to the collapse of Silicon Valley Bank and other banks. More regional banks are teetering on the brink.

The pace is quicker, the scale larger. The fallout from the few bank failures in the past six weeks already dwarfs the 25 during the 2008 crisis. If history repeats itself—

What's looming in the coming years?

Despite these signs, there are optimists like Jerome Powell talking about soft landings. Are we in denial, or can we still hope for a gentle descent? As others have pointed out, the parallels with 2008 are striking.

An interesting twist this time around is the emergence of Central Bank Digital Currencies (CBDCs). This reminds us of the emergence of Bitcoin in 2009, another innovation that was born out of financial crisis…

My though bubble:

Could CBDCs offer a solution to such crises? Or could they add another layer of complexity to an already tumultuous situation?